Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Good morning. I’m making another plea to please fill out our brief survey! We want to know how to make this newsletter more informative and helpful for you.

I assure you that we are reading the responses and taking the feedback to heart. Whoever it is who told me to talk more about Chicago, you are my favorite subscriber.

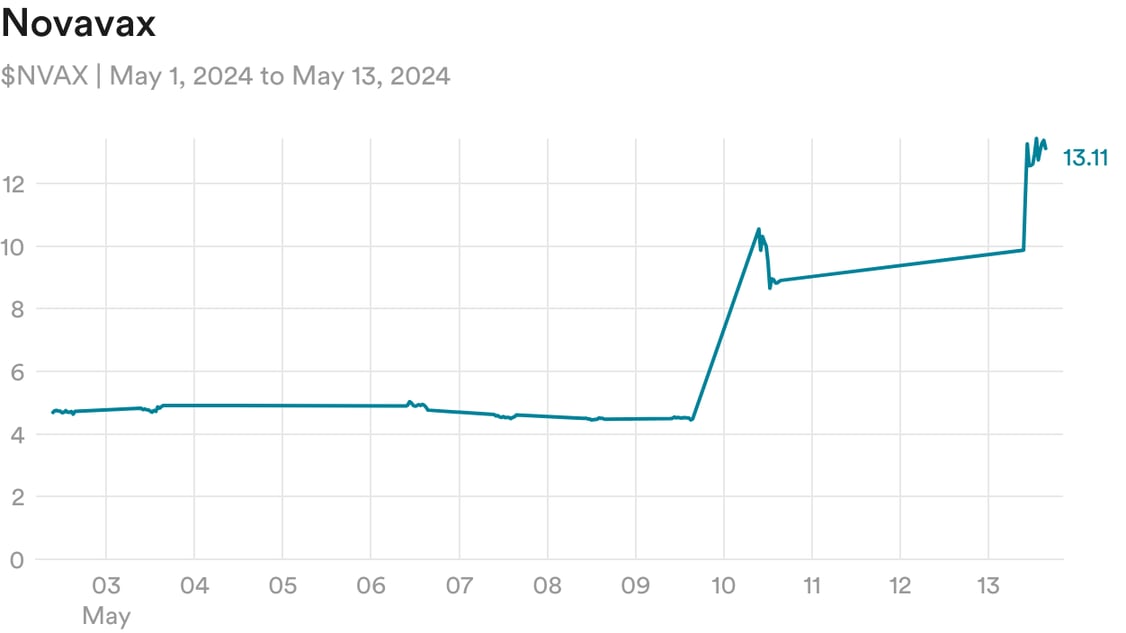

Is Novavax a new meme stock?

Roaring Kitty, one of traders central to the meme stock craze of 2021, is back, leading some of the original meme stocks like Gamestop and AMC to soar over 70% yesterday. Alongside them is Novavax, which had surged 99% last Friday and rose another 48% yesterday.

What’s behind this move? The impetus was that on Friday, Sanofi announced a licensing agreement with Novavax to co-commercialize its Covid vaccine and develop new flu/Covid combination vaccines. But Novavax is a highly shorted stock, with almost 40% of its share float sold short, so as the stock rose on the news Friday, that led to a short squeeze, in which short sellers have to rapidly buy shares to close out their positions, further sending the stock up.

This extended into yesterday, as Roaring Kitty’s comeback riled up a meme stock resurgence and traders looked for highly shorted stocks to squeeze.

With the return of wastewater surveillance and PPE in response to the H5N1 bird flu, and now a revival in meme stocks, it’s looking eerily like 2021.

Cytokinetics vs. Bristol in rare heart disease

Cytokinetics’ drug for obstructive hypertrophic cardiomyopathy (oHCM) could be used more flexibly than a similar treatment sold by Bristol while delivering similar levels of efficacy and safety, according to new Phase 3 results released yesterday.

Bristol’s drug, called Camzyos, carries a risk of low ejection fraction and heart failure, so it’s only available through a restricted program called REMS. Doctors have to halt treatment if patients’ ejection fraction drops below the normal range and must constantly monitor patients to see if they can restart therapy. This strict program is the “Achilles heel” of Camzyos, one doctor told me.

But in the new trial of Cytokinetics’ drug, called aficamten, researchers showed that they could lower doses rather than completely halt therapy for patients whose ejection fraction dropped. (The Camzyos trial didn’t test this.) If the FDA is persuaded by this data and allows doctors to follow this protocol, then aficamten could be more attractive to cardiologists and patients.

The question now for Cytokinetics is how, as a small company, it’ll be able to compete against pharma giant Bristol on the market. Read more from me on the details of the results and the company’s plan for commercialization.

The upstart going up against Illumina

Amid a difficult financial period for genome sequencing companies, with several laying off workers, Element Biosciences is still trying to make inroads in a competitive market.

Since it launched its $290,000 sequencer, dubbed Aviti, in March 2022, the company has continued to see modest growth. It now has 150 instruments installed in more than 25 countries, according to a sales update Element shared exclusively with STAT.

But Element has still has a long way to go to catch up with its rival Illumina, which dominates 80% of the sequencing market and has more than 23,000 instruments in use around the world. That includes a $335,000 sequencer with a similar output to Aviti.

Still, Element’s CEO thinks the company can compete with Illumina on affordability, she told STAT’s Jonathan Wosen: “The value we propose to customers is that, regardless of their funding situation, they’re able to afford this top-notch sequencer in their own labs with a very fast turnaround time.” Read more from the interview.

FogPharma finds a partner for radiopharma

From STAT’s Allison DeAngelis: FogPharma said today that it’s partnering up with a new startup called ARTBIO to co-develop new radiopharmaceuticals. FogPharma is best known for making corkscrew-shaped helicon peptides, which it believes can better bind to cancer targets and block harmful cellular signals. The hope is that these peptides can actually help deliver ARTBIO’s radiation to targets on cancer cells.

Novo Nordisk’s move into rare disease

From STAT’s Jason Mast: Contrary to popular belief, Novo Nordisk scientists do things besides think up novel ways to turn fish biology into obesity drugs. Sometimes, they make rare disease treatments.Yesterday, the Danish pharma announced its hemophilia A antibody, Mim8, proved successful in a Phase 3 trial, dramatically reducing the rate of bleeds, when given once a month or once a week. Among participants who weren’t previously on prophylaxis, bleeding rates fell between 97% and 99%. Among trial participants who were previously on conventional prophylactic treatment, Mim8 reduced the risk of bleeding by 48% when given weekly and 43% when given monthly, compared to participants who continued on conventional treatment.

The question is how patients and doctors will consider the detailed data, when available, against Hemlibra, Roche’s blockbuster, once-a-week hemophilia drug, which has let many patients live nearly symptom free.

TD Cowen analyst Michael Nedelcovych wrote that Mim8 could gain traction despite entrenched competition, noting that it appears to have led to higher rates of zero treated bleeds than what was seen in Hemlibra trials. And on safety, an earlier trial of Mim8 showed a lower rate of injection-site reactions than what’s been seen in Hemlibra trials, Nedelcovych said.

More reads

- USDA, FDA turf battles hamper responses to outbreaks like H5N1 bird flu, STAT

- Sandoz disavows U.K. trade group over dispute about promoting a biosimilar for multiple sclerosis, STAT

- AbbVie goes deeper into neuroscience with collaboration worth as much as $2B, Endpoints

- Shionogi misses primary endpoint in Phase 3 for Covid-19 antiviral, Endpoints

- Sanofi gambles $80M on Fulcrum’s muscular dystrophy drug, BioPharma Dive

To submit a correction request, please visit our Contact Us page.

STAT encourages you to share your voice. We welcome your commentary, criticism, and expertise on our subscriber-only platform, STAT+ Connect